Pro Moving Services

Best Moving Companies of 2023

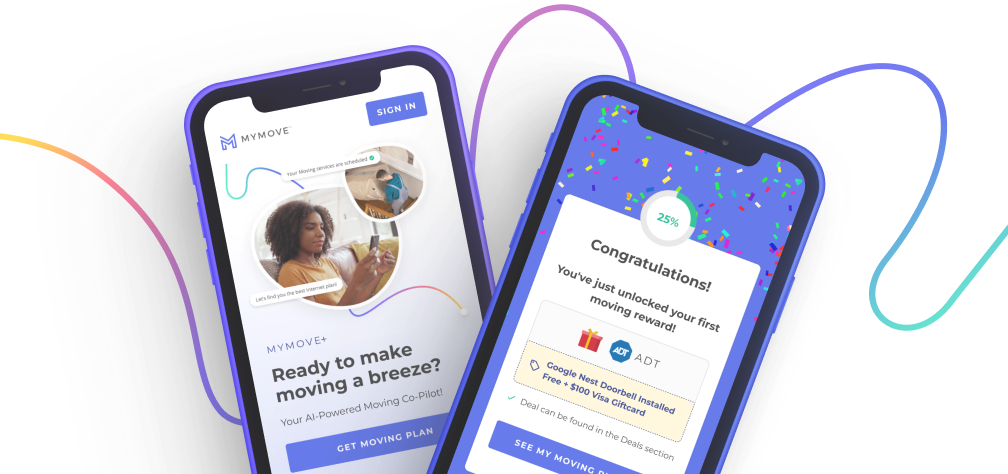

Plan, prep, set up services, and save on what your home needs most.

Happy about your move but stressed about moving? You’re not alone. Millions of movers a year turn to MYMOVE to streamline and stay on top of every moving detail.

Popular with movers and our moving experts

MYMOVE MARKETPLACE

Is your internet fast enough? Are you getting the best deal? Compare & shop plans from top providers near you in seconds.

Got a new guestroom or tired of your old mattress? Shop deals and read reviews of hundreds of top brand mattresses.

Your new home may mean a better rate. Compare, switch and save on auto insurance in seconds.

Behind every good move is a good plan… and patience

Explore allBecause making your new home yours is what it's all about

Explore all